LLP Registration Process Online | Documents & Cost Explained

Business / Nov 10, 2025

Starting a business is exciting, but choosing the right business structure is crucial for long-term success. For entrepreneurs looking for flexibility and limited liability, a Limited Liability Partnership (LLP) has become one of the most preferred choices in India. It combines the advantages of both a partnership firm and a private limited company.

In this blog, we’ll guide you through the LLP registration process online, list the documents required for LLP registration, and explain the LLP registration cost in India.

What Is an LLP?

A Limited Liability Partnership (LLP) is a hybrid business structure that blends the benefits of a partnership and a limited company. It allows partners to manage the business directly while limiting their liability to the amount they invest. Introduced under the Limited Liability Partnership Act of 2008, the LLP structure has become a popular choice for startups, small businesses, and professional service firms.

Why Choose LLP Over Other Business Structures?

Before diving into the LLP registration process, it’s important to understand why entrepreneurs choose LLPs over traditional business models:

- Limited Liability: Partners are not personally liable for the company’s debts.

- Separate Legal Entity: LLP has its own legal identity, separate from its partners.

- Low Compliance Cost: LLP compliance requirements are simpler and more affordable than those of private limited companies.

- No Minimum Capital Requirement: You can start an LLP with any amount of capital.

- Easy to Manage and Flexible: Changes in partners and management are simple to execute.

Step-by-Step LLP Registration Process Online

Registering an LLP in India is a completely digital process handled through the MCA (Ministry of Corporate Affairs) portal. Let’s look at each step in detail:

Step 1: Obtain Digital Signature Certificate (DSC)

Every designated partner must have a Digital Signature Certificate (DSC) for signing online documents. It’s issued by government-approved certifying authorities.

Documents required for DSC:

- Passport-size photograph

- PAN card (for Indian nationals)

- Aadhaar card or Address proof (Passport, Voter ID, or Driving License)

Step 2: Apply for Director Identification Number (DIN)

Each partner must obtain a DIN (Director Identification Number). This can be applied while filing the incorporation form for LLP registration online.

Step 3: Name Reservation of LLP

The next step is to reserve a name for your LLP using the RUN-LLP (Reserve Unique Name) service on the MCA portal.

The proposed name must be unique and should not conflict with any existing company or trademark.

Pro Tips for Choosing an LLP Name:

- Ensure it ends with “LLP” or “Limited Liability Partnership.”

- Avoid using restricted or prohibited words.

- Conduct a name search on the MCA and trademark databases.

Step 4: Filing the Incorporation Form (FiLLiP)

Once the name is approved, file the FiLLiP (Form for Incorporation of LLP) with the MCA. This is a crucial step in the LLP registration process. The form includes details such as:

- Registered office address

- Partner details

- Capital contribution

- Business activity description

Step 5: LLP Agreement Preparation and Filing

After incorporation, partners must execute an LLP Agreement, which defines the rights, duties, and profit-sharing ratio among partners.

This agreement must be filed with the MCA in Form 3 within 30 days of incorporation.

Key elements in an LLP Agreement:

- Partner contributions

- Roles and responsibilities

- Dispute resolution mechanisms

- Admission or retirement of partners

Documents Required for LLP Registration

Here’s a complete list of the documents required for LLP registration in India:

For Partners:

- PAN Card (mandatory for Indian citizens)

- Passport (for foreign nationals)

- Aadhaar card, Voter ID, or Driving License (as address proof)

- Passport-size photograph

- Bank statement or utility bill (latest)

For Registered Office:

- Rent Agreement (if rented property)

- No Objection Certificate (NOC) from the property owner

- Electricity bill, gas bill, or property tax receipt (not older than 2 months)

For Foreign Nationals or NRIs:

- Passport and address proof notarized by the Indian Embassy or consulate

All documents should be self-attested and scanned before uploading during the LLP registration online process.

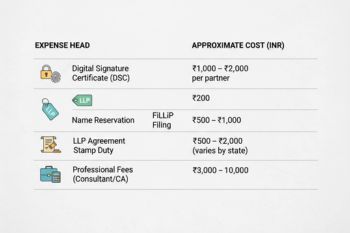

LLP Registration Cost in India

The LLP registration cost in India depends on factors like the number of partners, the state of registration, and professional fees. Here’s a general breakdown:

Total Estimated LLP Registration Cost: ₹6,000 – ₹12,000

For an accurate estimate and professional guidance, contact Legal N Tax, trusted consultants for LLP registration in Delhi.

Post-Registration Compliance for LLP

After completing the LLP registration process online, certain compliance requirements must be fulfilled to maintain the LLP’s legal status:

- LLP Agreement Filing (Form 3): Within 30 days of incorporation.

- PAN & TAN Application: Apply for LLP’s Permanent Account Number and Tax Deduction Number.

- GST Registration: Mandatory if turnover exceeds ₹40 lakh (₹20 lakh for services).

- Annual Filings:

- Form 8: Statement of Account & Solvency.

- Form 11: Annual Return.

- Maintain Books of Accounts: As per prescribed accounting standards.

Benefits of LLP Registration Online

Choosing to register your LLP online offers several advantages:

- Convenience: No need for physical visits; everything can be done through the MCA portal.

- Transparency: You can track your application status online.

- Speed: The process can be completed in as little as 7–10 working days with proper documentation.

- Paperless Filing: All forms and documents are submitted digitally.

Common Mistakes to Avoid During LLP Registration

- Submitting incomplete or mismatched documents.

- Choosing a name similar to an existing entity.

- Not executing or filing the LLP Agreement on time.

- Ignoring compliance deadlines post-registration.

Professional assistance from experts like Legal N Tax can help you avoid these pitfalls and ensure a smooth registration process.

Why Choose Legal N Tax for LLP Registration in Delhi

At Legal N Tax, we simplify the entire LLP registration process online for entrepreneurs, professionals, and startups. Our experienced consultants handle everything—from document preparation to final approval—saving you time and effort.

Our Services Include:

- Digital Signature (DSC) and DIN application

- LLP name approval

- Filing FiLLiP and Form 3

- Drafting LLP Agreement

- Post-registration compliance support

Whether you’re launching a new startup or converting an existing partnership, we ensure quick and hassle-free registration.

Conclusion

The LLP registration process in India is simple and fully online. However, understanding the legal formalities, documents required for LLP registration, and the exact LLP registration cost is vital before you begin. A well-structured LLP provides legal protection, flexibility, and tax advantages, making it ideal for small and medium businesses.

For expert guidance, reach out to the professionals at Legal N Tax — your trusted consultants for LLP registration in Delhi.

- Tel: +91-9810911733

- Email: mail@legalntaxindia.com

- Website: www.legalntaxindia.com

Share this with others: